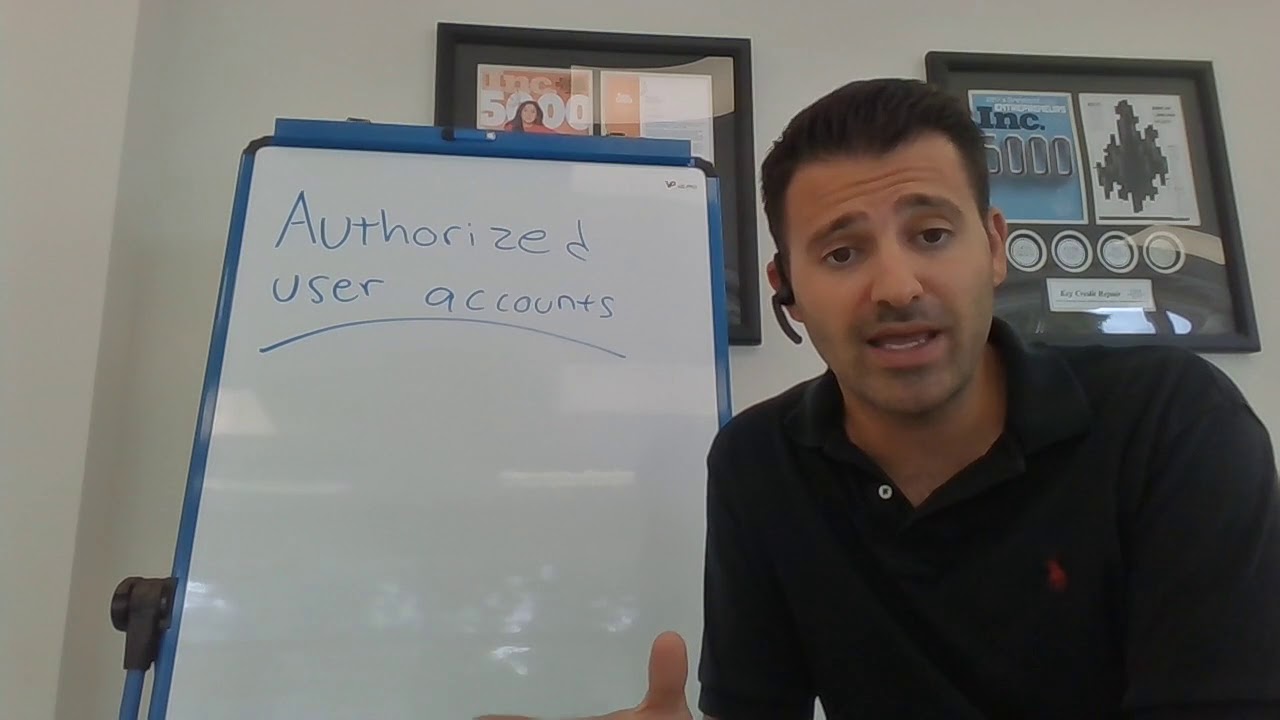

Authorized User Accounts-When do they start reporting?

Visit us online at https://keycreditrepair.com/free-consultation/

Click here for a free consultation https://keycreditrepair.com/free-consultation/

Click here to read more https://keycreditrepair.com/authorized-user-accounts-reporting/

Your Credit Minute Show Notes:

00:00 What’s up, guys? Nikitas Tsoukales here with Credit News Daily. Listen, I want to do a quick follow up video to our last video. You probably already watched this. Um, trade line. Should I buy them? Um, if you’ve seen that video, I just want to add a little bit of something. I’m really just elaborating on authorized user accounts. If you remember from the last video, we were talking about authorized user accounts, and the big question we go, we get. Should I become an authorized user on someone else’s credit card, okay? So if you’re unsure what this is, an authorized user account is fairly simple. Okay, somebody you know, okay, has a credit card, and they make you a card holder on that credit card. For example, if you work for a big company, a lot of times they’ll say, “Hey, here’s a company credit card.” They’ve just made you an authorized user on that card. What you don’t realize is you actually get that positive reporting from that card to hit your credit report each month. So it’s a nice little loophole in building up some positive credit.

00:56 Now there are some companies that actually sell trade lines or sell the ability to get on to someone else’s authorized user account. They call it piggy bank, piggy banking, uh, piggy backing. Um, it’s super shady, totally illegal. Obviously stay away from it. But if you have a spouse, okay, that’s had a credit card that you’ve been paying on yourself for many, many years but you’ve never been on it, you can actually get placed as an authorized user on that card and start getting the reporting from it, okay? So authorized user account. What is it? You’re basically piggy backing off of someone else’s credit card, okay? Now, you don’t want to do this with any other credit card other than a spouse’s, okay? And the reason why really has to do with lending criteria. So a lot of banks and lenders have seen people in the past use this loophole to, to build up their credit, okay, and build up positive trade lines and positive activity without actually uh, being credit worthy, okay? So they’re on to you if that’s what you’re doing. It doesn’t work anymore, okay?

02:01 Fannie and Freddie, the companies or the government agencies that back the majority of our home loans these days, when they see that you have an authorized user account now on your credit report, they’re gonna ask you a question. Is it your spouse’s? If you answer no, they’re simply gonna tell you, “Get them removed so we can re-run credit,” because most major banks, lenders and the government agencies that are backing these loans just simply don’t consider them accounts. Okay, so even if you’ve got a temporary loophole lifting your credit because you’ve become the authorized user on your cousin’s credit card or your neighbor’s credit card, your boss’ credit card, guess what? It’s not gonna last, guys. It’s coming to and end, okay? But if you, if you’re added to your spouse’s card, you will get that positive credit and most major banks and lenders will allow you, um, to use it for, for your loan, understanding that it is one household. So it does affect your credit worthiness. Most likely you’re paying it with your wife or your, your spouse, right? Um, another thing is, uh, another question we get asked is, you know, do I get that person’s reporting from the beginning? Um, it used to be that when you became an authorized card holder on someone’s American Express, for example, okay? You actually got all of the previous payment history on that account. So let’s say you’re a pretty young guy, 20 years old, and your parents made you a cardholder on their American Express that they’ve had since 1965, technically speaking in the old days, you were getting all of that previous reporting from 1965 from before you were even born. Okay? It was one of the greater grand slams in artificially boosting your credit score. Um, that’s over with now, though. That does not exist, so when you become an authorized user on someone’s credit card, the reporting will start from the day you become an authorized user. You’re not getting someone’s previous history. The date open will be the date it was opened, the date you became a card holder, okay? So it’s something that I tell people to do a lot when it’s a spouse. If it’s not a spouse, stay away from it.

credit bureauscredit reportscredit score