1️⃣ Free Research Platform for Alternative Investments (Art) 🖼 Research and Diversification portfolio strategy: https://masterworks.art/larrycheung (Skip the Waitlist with my unique link)

2️⃣ ⬇⬇⬇ Get updates periodically from joining my email list: https://forms.gle/UxATVgAzngby1TfY9

3️⃣ Investment Community Inner Circle: (https://www.patreon.com/larrycheung)

4️⃣ Growth Marketing for Financial Advisors (Let’s have a coffee on Zoom): https://calendly.com/larrycheungcfa/institutional-investor

5️⃣ Exclusive Webull Invite Link (Claim your Free Stocks): https://a.webull.com/i/LarryCheungCFA

6️⃣ Exclusive Moomoo Invite Link (Claim your Free Stocks): https://j.moomoo.com/00gdrN

#StockMarket #Techstocks #SP500

😊 Please SUBSCRIBE to my channel and LIKE/SHARE this video if you enjoy my content. You are awesome!

⏰ ⏰ ⏰ Important NOTE: PLEASE WATCH in 1.5X or 2X speed if you are a more advanced investor

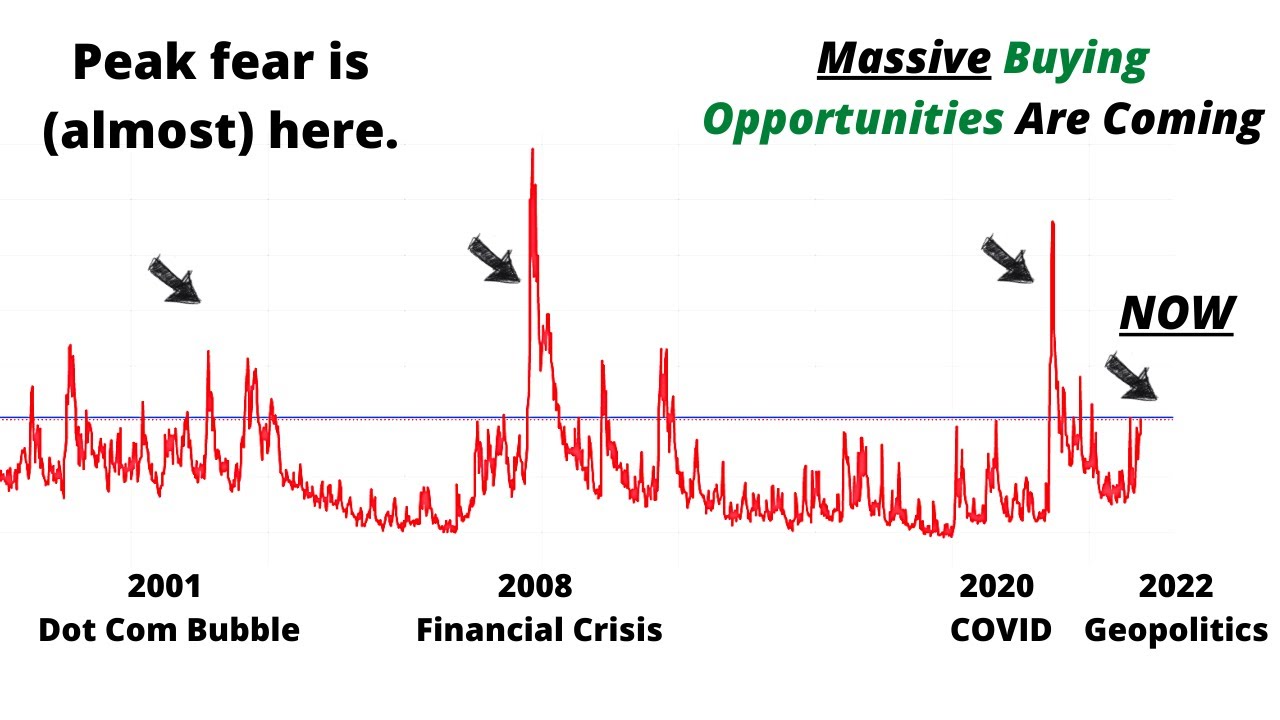

Summary: In this video, I talk about why I believe the S&P 500, Nasdaq, and Global equities could be setting up for a large bounce back rally in the coming months as geopolitical worries fade. The Federal Reserve is paying close attention to the Russia-Ukraine event as their commentary makes its way into the January Fed Minutes, far before escalation happened in February.

I also discuss important Macro and Sentiment indicators that are indicating that we may be reaching peak fear, such as the VIX index and also High Yield Credit Spreads that are indicating greater stress in credit markets.

I include very detailed coverage of what each Fed committee member is thinking ahead of the March rate hike and what that means for rate policy later this year.

I do not believe that the investment banks’ forecast of 7-8 rate hikes or more is likely to materialize given economic data that is going to be much softer in the coming months due to supply chain disruptions.

⌛ Timeframes:

0:00 - Welcome back my wonderful people - psychology and mindset training

7:06 - Why geopolitical tension could set markets up for a huge rally

15:16 - What does each Fed Committee member thinks about rates

18:35 - Powerful Alternative Investment Asset Class to combat and HEDGE Inflation

🖼️ More info about today’s sponsor Masterworks:

Invest in blue-chip art for the very first time by signing up for Masterworks: https://masterworks.art/larrycheung

Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more.

See important Masterworks disclosures: https://www.masterworks.io/about/disclaimer

Collabs/Partnerships/Strategy Discussion

🤝 Email me to chat about collabs/partnerships: Larrycheungcfa@gmail.com

Let’s be Social:

🔥 Follow me on Twitter: https://twitter.com/LarryCheungCFA

🔥 Follow me on Instagram: https://www.instagram.com/larry.g.cheung/

✍️ Follow me on Seeking Alpha: https://seekingalpha.com/author/larry-cheung-cfa#regular_articles

Disclaimer: All opinions shared in this video are mine only. Please do your own due diligence.

best stocks for 2022best stocks to invest in 2022federal reserve